How does Safe Haven make investing in cryptocurrencies safer?

One of the biggest obstacles to widespread cryptocurrency adoption is the inability of projects to provide safe custodial services. The average investor isn’t experienced or knowledgeable enough to safely handle their own keys and backups, resulting in the loss of tokens due to both negligence and misfortune. Unlike a bank, cryptocurrency projects are unable to restore access to funds, making an already risky investment even riskier.

This was made painfully clear after Canadian-based exchange Quadriga claimed they lost access to $190 million dollars when the founder and CEO suddenly passed away in December of 2018. Apparently, he had “sole responsibility for handling the funds and coins,” leaving the remaining employees with no ability to return funds back to customers.

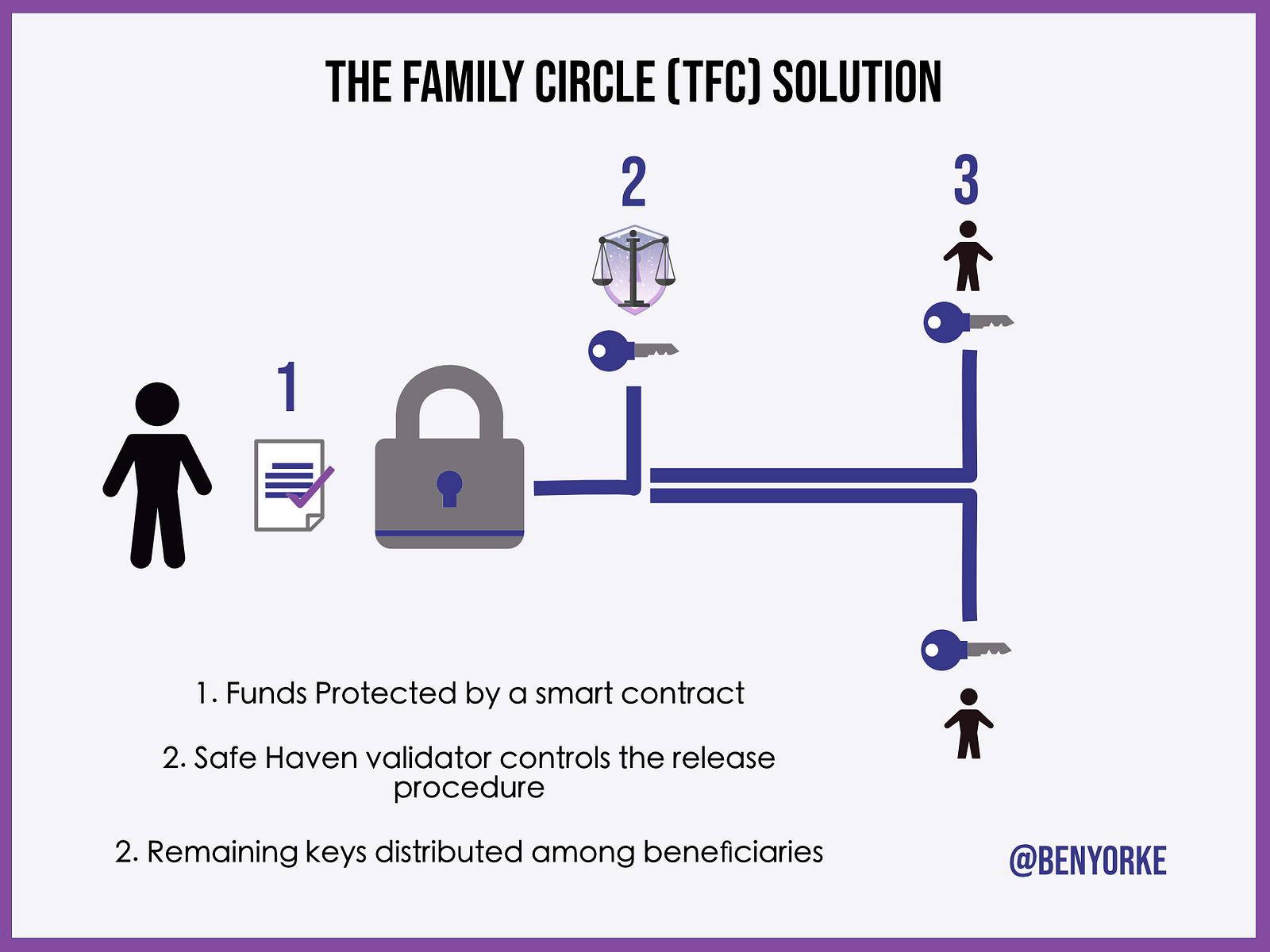

Fortunately, Safe Haven is working on many solutions that aim to make custodial services safer, even in the event of an accident. By securely splitting up the keys to your investment, you or your heirs could provide legal documentation to regain control of your assets.

Here’s a quick look at how it all works:

A key aspect here is the creation of the Safe Haven Trusted Alliance Network (TAN), a network of legal professionals that can trustlessly validate the release of tokens by being provided with legal documentation, such as a death certificate. By dividing your Safe Haven keys among multiple beneficiaries, you can ensure that the funds can’t be released unless all beneficiaries agree to dissolve the smart contract.

The nature of this trustless agreement has more applications than just digital inheritance. It also works great in situations where friends, companies, or even strangers on the internet would be interested in pooling their funds for staking or fundraising purposes. Without a TAN legal professional, and the consent of all members, the funds can’t be accessed or released.

TAN goes far beyond just facilitating these agreements. TAN is an ambitious project that will encourage lawyers and legal professionals to be educated in cryptocurrencies, so they can expand the type of services they provide to clients:

- It will involve an entire legal network, including profiles that can be browsed by prospective clients

- It will reward the publishing of legal documents, so that lawyers will have better access to information regarding cryptocurrencies through the network

- TAN will connect users with crypto-friendly professionals for services like document writing and mediation

2019 Outlook

Safe Haven has kicked off 2019 with a flurry of announcements. Early in January they announced the launch of their new website. The new site brings a new level of professionalism to the platform.

Next, they released the alpha version of ThorPay, a tool that allows registered users of the Safe Haven network to send multiple transactions at once by using VeChain’s multi-clause transaction feature. This simplifies the process for users who need to send complex transactions, but don’t want to bother with writing their own complex smart contracts.

On January 30th, Safe Haven announced their Safe Masternode Program. Holding large amounts of the Safe Haven Token entitles you to a share of the fees earned by the platform.

Row 1: Node name Row 2: Minimum holdings

Row 1: Node name Row 2: Minimum holdings

Row 3: Share of rewards pool Row 4: Maturity period

For more details, check out the announcement.

What is the token used for?

SHA tokens are VIP-180 tokens on the Vechain blockchain.

The SHA token is necessary for the creation of smart contracts used in their digital inheritance solutions. These SHA tokens are also released upon the validation (completion) of a smart contract.

The ThorPay solution mentioned above requires SHA to complete.

ThorBlock, a pooling solution on the Vechain blockchain, allows companies, projects, or individuals to raise funds. Plair, a gaming ICO on the VeChain network, held their public sale using ThorBlock. Users could submit VET tokens as payment, and once the goal was met, had new PLA tokens automatically distributed. In the future, companies or projects wishing to raise funds will be required to stake SHA tokens while the fundraising is ongoing.

Finally, legal professionals wishing to take part in the TAN network must subscribe by locking up SHA tokens for the duration (365 days) of their subscription. They will be encouraged to do so by the number of additional clients they can receive, as clients begin to seek out potential validators for their digital inheritance or pooling solutions.

More information, including a roadmap, is available on the website here.

Where can I buy SHA tokens?

Currently the SHA tokens are available on a number of platforms, including OceanEx.