Why governance matters: Blockchain Governance with Peter Zhou and Max Ren

All projects and organizations need a governance system to make and enforce decisions. This is true whenever multiple actors collaborate regardless on whether it’s a governmental state, business or family. According to Thomas Cox (Chief Governance Officer at StrongBlock), In the case of blockchain, governance helps to deal with emergent issues that “transcend what the settled code can handle”.

Different blockchains use different governance structures and during VeChain’s 8th webinar, Dr. Peter Zhou and Dr. Max Ren analyzed some of these processes and how effective they have been.

Bitcoin

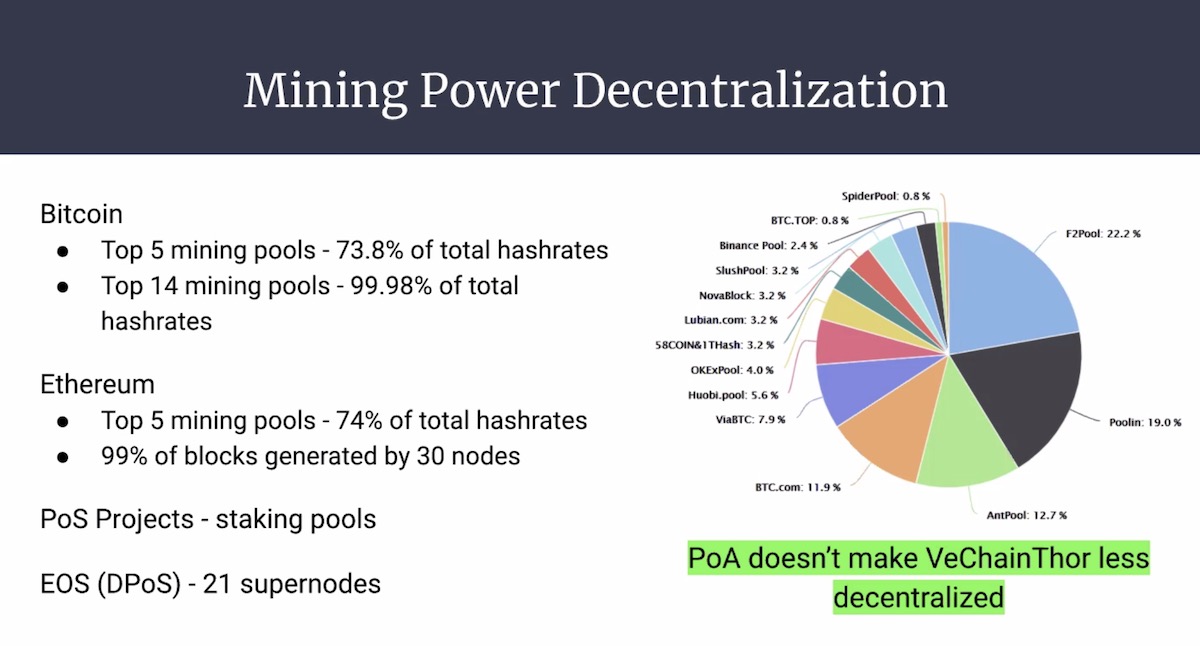

As the first decentralized digital currency, Bitcoin was designed with free governance structure to avoid entities gaining too much power and authority and, ultimately, giving control to the users. Not having a systematic way make decisions, however, has led to inefficiencies and community conflicts. As an example, Dr Max Ren referred to the disagreements that occurred when dealing with Bitcoin’s scalability limitations. While different solutions such as increasing of block size or the lighting network are available, opposition and conflict of interest between core developers and miners has slowed the deployment of Bitcoin Improvement Protocols (BIP) and resulted in forks such as Bitcoin XT or Bitcoin Cash.

Ethereum

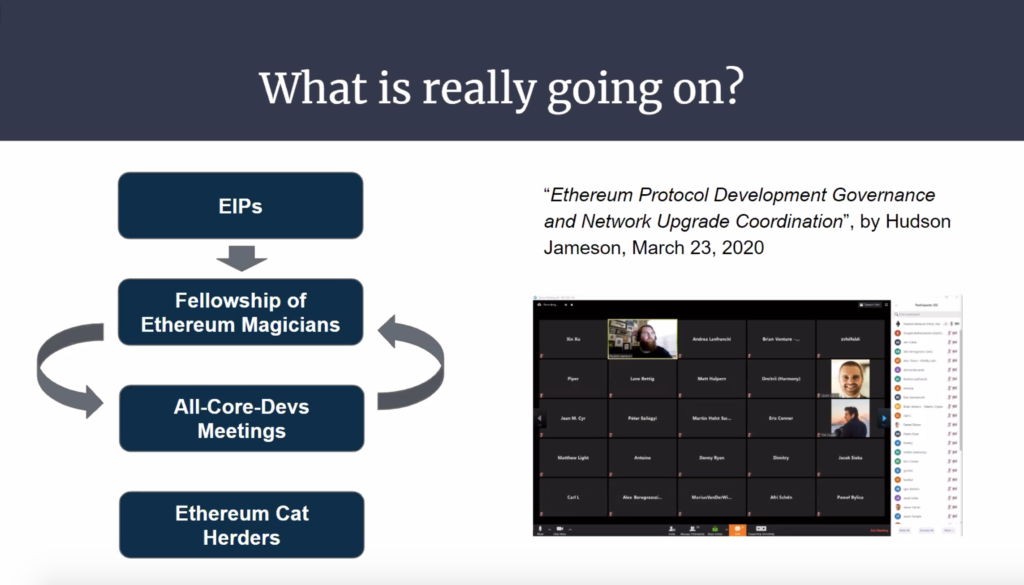

Ethereum on the other hand has a more methodological decision making process. New features are submitted to the Ethereum Improvement Proposals (EIP) repository, which are then discussed in the Fellowship of Ethereum Magicians forum and (with enough support) considered for development during All-Core-Devs Meetings. Core developers have the final say and decide whether a proposal is to be implemented or rejected by carrying a “rough consensus”. This gives developers significant power and, while not all of their identities are known, having a clear roadmap, the existence of the Ethereum Foundation and the presence of figureheads like Vitalik Buterin has helped guide the community and give direction to Ethereum’s growth. According to Hudson Jameson (Developer Liaison at the Ethereum Foundation), the community is also “taking up the torch to decentralize processes“.

EOS

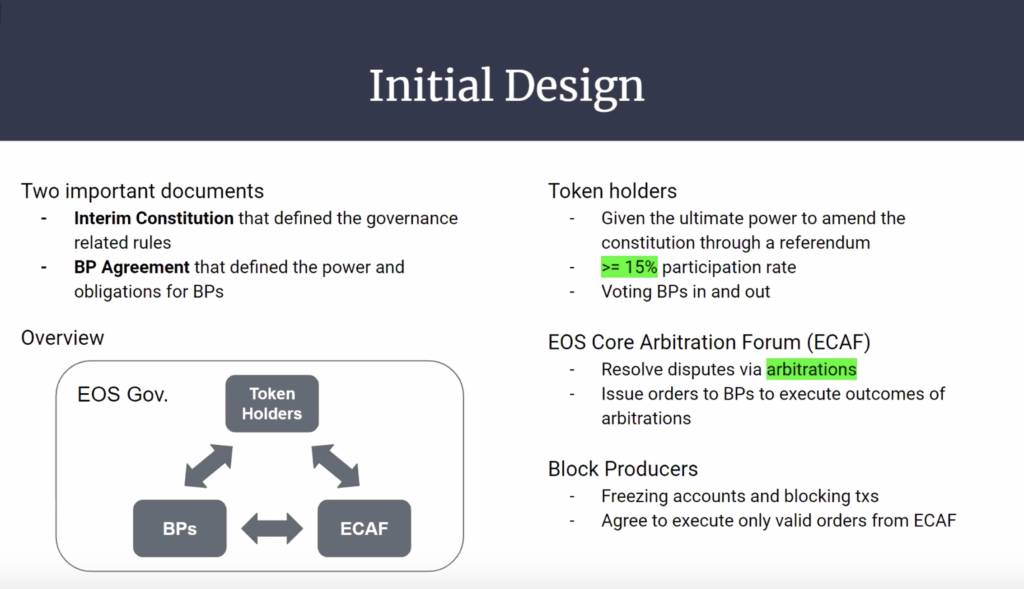

EOS governance is influenced by its Proof-Of-Stake mechanism. In the network, 21 block producers are elected by token holders and given authority to confirm transactions.

Initially, EOS governance was set by rules in its Block Producer Agreement and Interim Constitution. According to the documents, block producers could only execute valid orders passed by the EOS Core Arbitration Forum (ECAF), which in turn was responsible for dispute arbitration and resolution. In June 2018, however, the constitution was breached when block producers decided to protect users from bad actors by freezing 7 accounts without prior ECAF consent. In the same month, a forged ECAF order requesting the freezing of 27 additional accounts was also discovered; creating internal conflict and causing the community to question the effectiveness of its governance processes. As a result, block producers eventually replaced the constitution with the EOS User Agreement (EUA) which, while it removes enables smoother decision making by removing the ECAF, does not include a “No Vote Buying” clause and gives block producers significant control voter the network. This has led to concerns about centralisation and collusion as reported in a recent Binance Research article.

VeChain

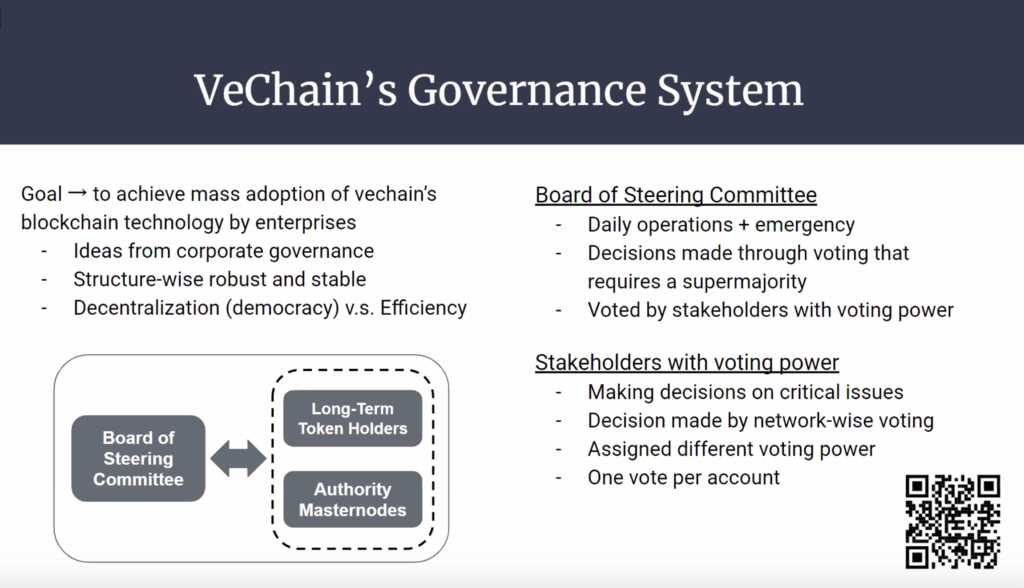

VeChain’s governance model has been designed to balance decentralization with effective decision making. At its core, a stakeholder elected Board of Steering Committee is responsible for overseeing daily operations and resolving emergency situations.Token holders, however, have the final say on the implementation of fundamental changes.

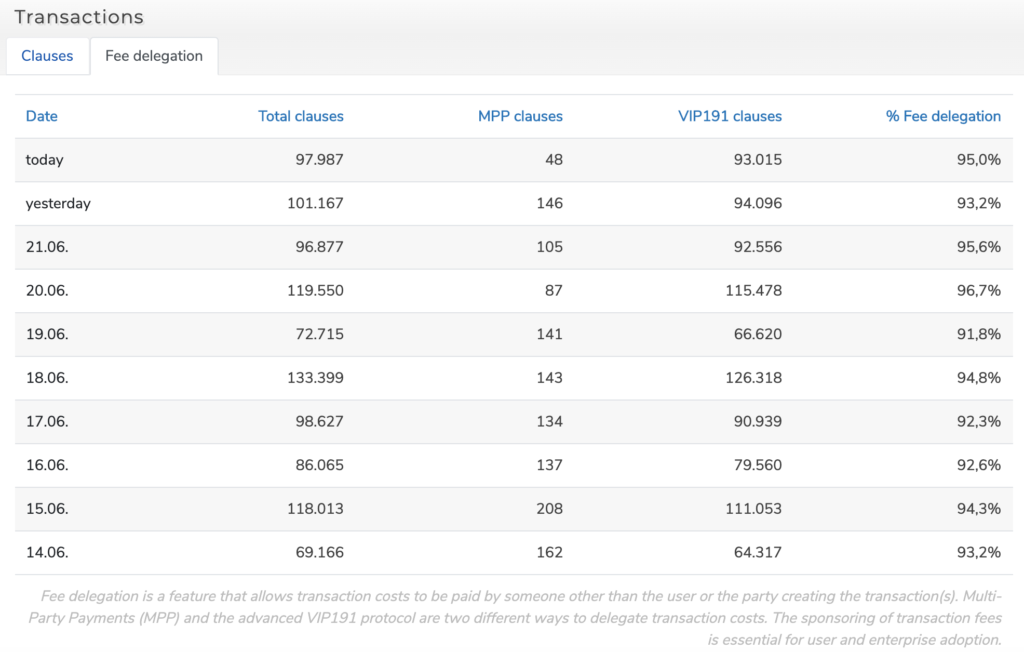

New features can be proposed by both the Committee and the community (e.g. VIP-191 proposed by Totient) but need to be approved by a supermajority of Steering Committee members. Approved proposals are then presented to the community where Authority Masternodes and token holders with voting rights (i.e. node holders) can decide whether the to accept the new features. If the community does not agree, the changes are not integrated into the blockchain. To mitigate the influence from bad actors voting rights are only granted to long-term token holders that stake a minimum amount of VET for a minimum amount of time (allowing them to upgrade into a node). Depending on the amount of VET staked, users can upgrade to different nodes carrying varying voting power. This helps maintain voting integrity and ensures voters have the ecosystem’s best interest.

VeChain’s governance structure allows fast action to be taken during emergency situations while keeping ultimate control with its users. The system proved to be effective when 1.1 billion VET were lost in December 2019. In response to the theft, the Steering Committee was able to immediately mobilize, contact the relevant stake holders and jointly release an emergency patch to freeze the stolen tokens. This helped mitigate the issue and by letting the community vote whether to permanently implement the temporary solution, token holders were able to decide the networks future, maintaining the blockchain’s integrity and decentralization.

To protect community voters from harassment or being influenced to make certain decisions, VeChain is also developing an e-voting solution that will protect their privacy.

Wanna share with #VeFam that I’m working on a practical e-voting solution that preserves privacy. Progress can be found at https://t.co/DHRJp1QbfZ. Will write about it once I’ve done the initial implementation and testing. #VeChain $VET

— Peter Zhou (@PeterZh47977516) July 29, 2020

It is important to note though that network upgrades are still carried by VeChain core developers and therefore, for VeChain’s governance to succeed, the Foundation, Authority Masternodes and the Steering Committee’s actions need to remain transparent, ethical and accountable towards the community which so far appears to have been the case.

There is no perfect or “one size fits all” governance structure, however, VeChain’s system appears to be ideal for its enterprise-centric applications. Having an unstructured governance like Bitcoin could lead to slow upgrade implementations and inefficient decision making (turning businesses away). By balancing the role of the Board of Steering Committee and all stakeholders, VeChain gives users control over the network while being able to also take fast and effective actions to respond to sudden issues.

A recording of the video can be found below: