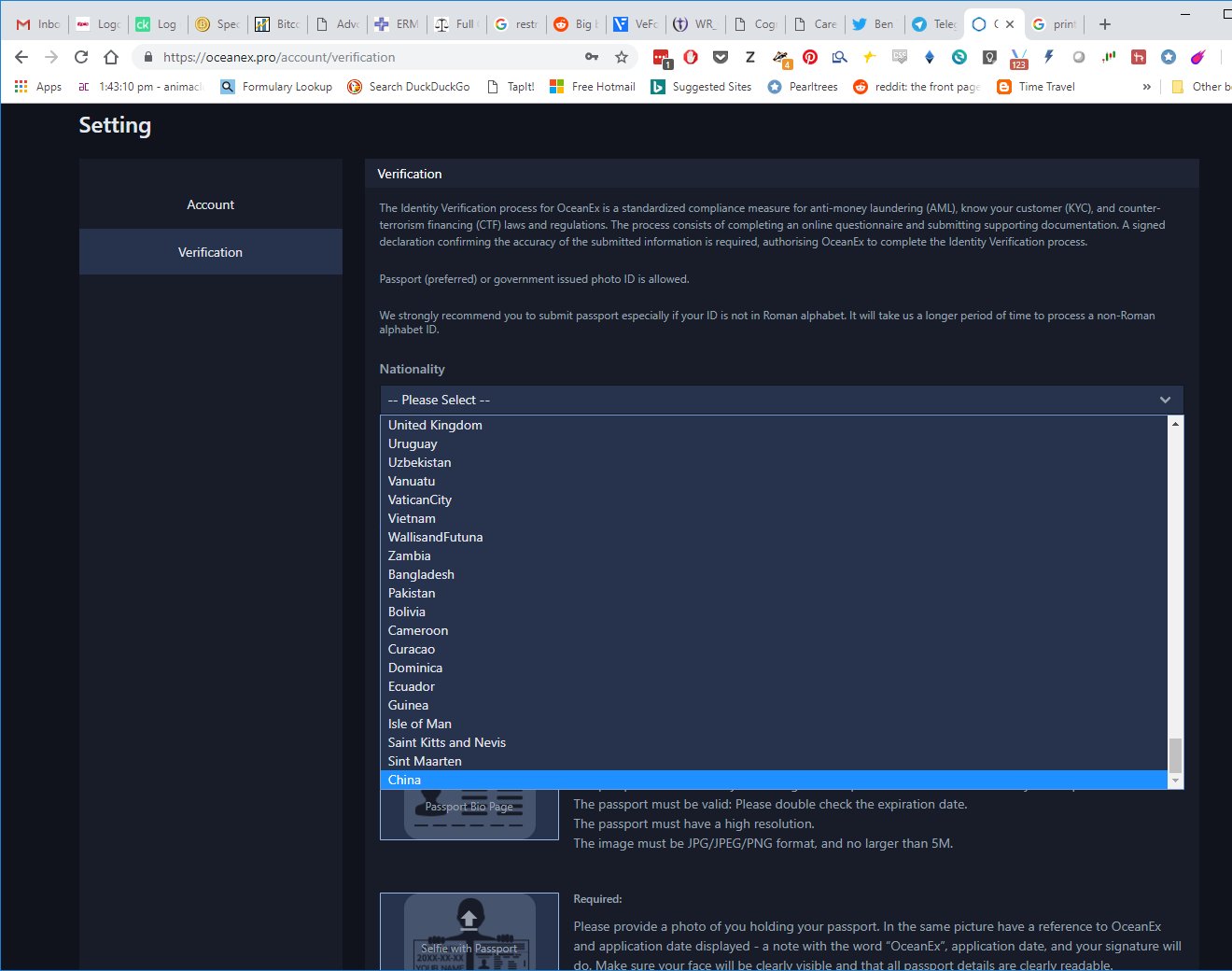

On Wednesday, January 24th, the biggest rumor was surrounding OceanEx’s decision to allow Chinese citizens to both access the site and submit KYC documents. This comes after the platform had blocked Chinese IP addresses for more than 2 months since launch.

Photo Credit: Twitter User @joejd414

Since then, I tested it, and was in fact able to submit KYC documents using a Chinese passport – without a VPN. This opens up the exchange to a very large percentage of the world’s population, and one that that has traditionally not shied away from speculative investments.

A lot of people were confused by what this means for OceanEx and digital currencies in general. Many people mistakenly believe that China has been frozen out of the market after national policy banned ICOs and exchanges in the spring of 2018. Those who have followed Chinese policy, or lived in the country, know that things are never that simple. To begin, I must understate that China, as a region, never truly left the market.

Digital payments and eCommerce are staggeringly overwhelming in China. Alipay and WeChat have all but replaced cash for many individuals, and QR codes are everywhere – convenience stores, taxis, street vendors, and subway turnstiles. This has supported an ever-present OTC market, where citizens can quickly exchange RMB for digital currency with other consumers (c2c). Huobi, OKEx, OTCBTC, and Gate all allow such transactions, enabling users to purchase BTC or ETH in minutes. The process is quite simple – at times even easier than in western countries.

Huobi’s OTC platform

So where are we now?

One of the biggest problems with trying to interpret ‘rule of law’ in China is that there is very little consistency. For exchanges, they can only guess what is allowed, and how the policy will change in the future. Larger exchanges, such as Huobi, are definitely working under the government’s watchful eye to create infrastructure that fits into the legislation. Clearly, Huobi’s decision to move operations to Hainan last month reflect that. Hainan, an island south of the mainland, is the newest special economic free-trade zone, that is tipped to be China’s answer to Silicon Valley. It has a focus on internet companies, and government development overseers wouldn’t be letting just anyone move in – clearly Huobi is operating legally at this stage. If you follow the press releases of major cryptocurrency exchanges – notably Binance, you’ll see they have a distinct lack of communications regarding Chinese development. To a westerner, that would come off as a sign that talks are on hold. For China, it merely means that the companies aren’t discussing it publicly. Don’t be fooled – CZ hasn’t just abandoned the world’s largest region to go hunt for new startups in Malta and Uganda.

For OceanEx, the fact that they have set up shop in the capital city of Beijing shows they are committed to focusing on compliance. Their latest decision to allow Chinese users probably isn’t part of some breakthrough in policy, rather it’s more likely the realization that Chinese policy is heading in a new direction – one that is supportive of local platforms and avoiding widespread bans. The Cyberspace Administration of China has made that fairly evident, with their new regulations going into effect next month. Overall, this is good for the entire industry, but especially good for projects that have been playing by the rules and sticking close to home.

Global Trade Wars and Huawei

For those that haven’t been paying attention, China has a major issue to deal with. Their technological pride and joy – Huawei, has been dealing with scandals stretching from North America to Australia and New Zealand, as well as Oxford University. China realizes they are deep in a technology war that will shape the future of the internet and global commerce – with stakes so high that losing is unacceptable. For those looking for more info, I recommend reading this article on “the split-ernet.” Author Michael Spencer talks about how China is churning out superior internet services, buoyed by the national centralization that can support them. This allows products like WeChat and Taobao to gain unfathomable levels of market penetration.

For exchanges, this means that we are not headed in a direction where local platforms are banned. China can’t afford to allow its users to flock to western platforms. There simply isn’t a scenario where China doesn’t support their homegrown tech projects on a global scale – just ask a Canadian what lengths they will be willing to go.

For these reasons, I’m particularly optimistic about what a “tech race” might mean for local platforms such as OceanEx, Huobi, and OKEx. They stuck around in Beijing throughout the hard times, and will undoubtedly be rewarded through favorable policy in the future. Will it happen soon? Hard to say – but I wouldn’t be shocked to see the framework for exchange licenses being built this year. Once that happens, the floodgates of RMB investments will be thrown wide open.