Introduction

The release of browser-based tools such as Comet and Arkane Network has given users a means to interact with assets directly through their webpage. Vexchange, the first third-party website to integrate these tools, is launching in Beta this week. This will give users a fast and safe way to transfer between VET, VTHO, and other VIP-180 tokens, such as Safe Haven, Plair, and DecentBet. Vexchange will solve one of the biggest problems faced by users of the VeChain ecosystem – being able to seamlessly trade assets. It will also benefit the ecosystem in other ways, allowing users to earn rewards by staking tokens within the platform, while providing liquidity, and increasing the activity on the blockchain.

What is it?

Vexchange is a decentralized exchange, so that means there is no depositing of funds or waiting around while withdrawals process. When users wish to make a transaction, tokens are swapped and instantly returned to the user’s wallet. Since it is non-custodial, the threat of hacking or theft is greatly reduced. Decentralized exchanges are peer-to-peer and transparent, removing the need for KYC. Every transaction is on-chain (VeChain’s blockchain) which consumes VTHO, further supporting the VeChain two-token economy. Since the on-chain transactions are publicly available, wash-trading and other manipulation is much harder to conceal.

For any exchange, security is always the number one priority. With that in mind, we asked the founder of Vexchange some questions regarding basic concerns a user might have.

Q: How do I deposit or withdraw funds on Vexchange?

Notice: Trading is currently disabled as the project is in Beta. Trading will launch later this week. For now, only the pooling feature is available, so that users who choose to stake can deposit liquidity and become familiar with the site. For users who encounter bugs or errors, please post them in the Telegram.

To trade on Vexchange a user does not need to deposit or withdraw funds as trades are completed instantly, within one transaction. However, the exchange allows users to deposit their tokens and VET in order to act as liquidity providers. Liquidity providers earn fees generated by the exchange in return for staking their assets.

Q: How do I know my funds are safe?

The exchange’s contracts have been audited by SmartDec and can be reviewed by the public here. If you are trading you do not have to worry about the exchange being hacked, due to the fact that you do not deposit with the exchange and trades are settled in one transaction. However, if you are staking on the exchange, then the audit and public scrutiny will greatly help reduce risks, especially as Vexchange builds a track-record.

Q: Are there any fees associated with using Vexchange?

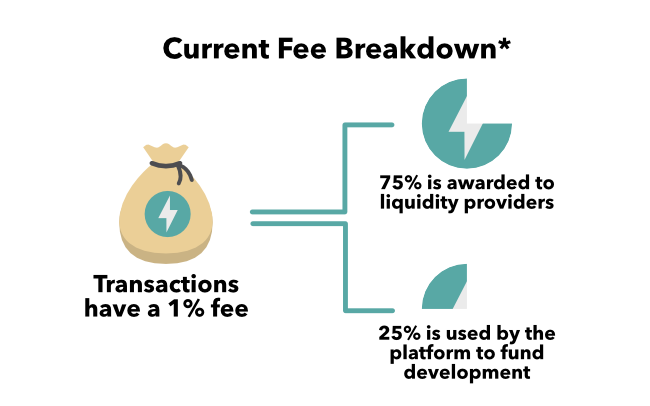

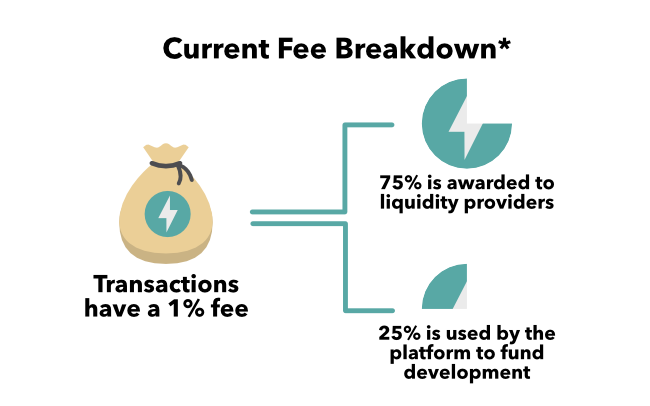

Vexchange charges a trading fee in order to incentivize liquidity providers. This fee gets distributed to liquidity providers as a means of payment for the liquidity they have staked. This fee remains in the contract until withdrawal, so by default the liquidity will grow with each trade, gradually increasing the exchange’s efficiency. Note: At the time of publishing this post, the fees were 1%.

Fees may be adjusted and optimized over time.

For liquidity providers there is also a percentage fee charged on their earnings as a means of funding further development of the exchange and complimentary products. Swap fees will trend downwards as each market’s liquidity and efficiency increases. Platform fees will be adjusted based on the current return experienced by liquidity providers, likely with a long-term downwards trend.

Q: Does the VeChain Foundation endorse Vexchange?

We have not approached the VeChain Foundation on this matter but as this is an organic community project with no foundation involvement. We saw a problem in the market and set out to fix it, as all good projects do. It is our hope that the foundation will appreciate and promote the product we have brought to market but that is definitely not a requirement for us to move ahead.

With security issues resolved, we wanted to explore how users could better extract value from the platform.

Q: What is your vision for the future of Vexchange?

Beyond growing the liquidity for existing trading pairs and ensuring a smooth mainnet launch, we look forward to cross-chain assets. We believe that the addition of cross-chain assets to VeChain would be a major boost for the ecosystem and would give us access to cool tools like stablecoins.

Beyond cross-chain assets, we look forward to working with other ecosystem members to enable instant swaps in their applications. This can greatly help with user on-boarding and abstracting token acquisition away from the user.

Q: How can Vexchange benefit me? (Guide to staking)

The Vexchange ecosystem has a role known as the liquidity provider. This basically means you stake your assets in their respective market in order to improve available liquidity and reduce the slippage in trades. Slippage refers to how far the price moves based on your order size. In essence, the more liquidity there is staked, the larger the trades the exchange can handle.

One important thing to note is that you should check the exchange rate before staking, make sure you are happy with it as it will set the base price for your assets. It is important you are happy with this exchange rate because as it shifts, you may end up with more of one currency than the other. As such, it’s important to only stake assets you are comfortable with holding, otherwise you could be left holding more of a particular asset than you wanted.

Part Two: Staking Tutorial

The exchange functions because of liquidity. This means users have volunteered to submit and store equal amounts of both VET and a separate token into the platform, so they will be available to other users when they want to exchange them. You can take part by pooling your own assets.

Staking assets entitles you to a share of the transaction fees. Each transaction fee is split up, to be distributed proportionally to the users providing liquidity to the exchange. That means the more volume occurring on the exchange, the more you earn. In this tutorial, I’m going to pool PLA. (With Arkane Network, you just need to sign up for a wallet on their website and then link the account from within Vexchange.)

Setting Up

First: Download either the Google Chrome Browser or the Brave browser. In the Google Extensions store, download Comet. Link here.

Second: After Comet is installed in your browser, set up a new account in comet, or import a previous account using your mnemonic phrase or a keystore file. You should see the comet icon to the right of your address bar (Fig. 1). Click it, and make sure the passcode is entered to log in. Find your new public address, and use it to deposit the VeChain assets you wish to swap out. If you don’t have any VeChain assets, you can buy them on websites like Binance or OceanEx. Currently tradable assets include VET, VTHO, SHA, PLA, and DBET. Check coinmarketcap.com for the best places to buy these assets.

Note: You will also need VTHO to complete the transaction submitting your tokens to the pool. In this tutorial, I prepared by filling my Comet wallet with VET, PLA and VTHO (to be consumed for transactions).

Fig. 1

Once on Vexchange

Navigate to Vexchange. Once arriving, you may be prompted to login to Comet by entering your passcode. It will ask for confirmation to share your wallet information with the website. After clicking confirm, you should notice your Comet address in the top right corner (Fig. 2).

Fig. 2

Now we are ready to begin! Click on the Pool tab. Be sure to read the Terms of Service.

Fig. 3

As you can see, the first Deposit drop down menu is set to VET. VET must be one of the token pairs staked. This ensures the ratio is balanced, so that the algorithm governing the site can calculate exchange rates. Select the secondary token from the second Deposit dropdown menu.

Each token will need to be unlocked once before staking. This authorizes Comet to interact with the individual token contracts. Click unlock (Fig. 4) and confirm the pop-up notification from Comet.

Fig. 4

Then enter the amount you would like to stake (Fig. 5).

Fig. 5

In this example, I have opted to stake 100000 PLA tokens, and the market equivalent, 2308.4 VET. I will then click Add Liquidity. Both my VET and my PLA will be submitted to the staking pool. Note: I have already completed this transaction once as a test, so the small print underneath will appear differently from yours. If this is the first time you are staking, your pool share will show 0%. You can expand the transaction details to view more information about the transaction.

Clicking Add Liquidity will trigger a confirmation pop-up (Fig. 6). If you have a pop-up blocker turned on, you may need to click the Comet icon in the address bar.

Fig. 6

After clicking Confirm, you can now see your pool contribution underneath the pooling menu (Fig. 7). When creating this tutorial, I was the only one staking PLA, so my percentage is shown as 100%. As other users contribute, my percentage will decrease.

Fig. 7

And that’s it! You can remove your pooled funds at anytime by clicking the Add Liquidity dropdown menu and selecting Remove Liquidity.

How does the algorithm work?

NOTE: Over time, your share of each token will adjust to reflect the market value of the token. Let’s give an example to show how the algorithm works:

New Random Token (NRT) joins the ecosystem. It’s added, and starts trading at 10 to 1 with VET. You stake 100 NRT and 10 VET. Over time, NRT shoots up in value, to be worth a 1:1 ratio with VET. The liquidity pool would constantly be adjusting for added demand, and your withdraw-able staked funds would now be adjusted, plus whatever transaction fee bonuses you have accrued over that period. Here’s how it works:

100 NRT and 10 VET = 1000 INVARIANT

if ratio shoots to 1:1 we get:

31.62 NRT and 31.62 VET (sqrt of 1000)

So that NRT * VET always equals INVARIANT

31.62 * 31.62 = 1000

Links:

Vexchange Official Twitter

Vexchange Official Telegram

Please note: Always be aware there is risk to using exchanges or pooling funds, even though Vexchange has been audited by a third-party to safeguard against hacks or external threats. VeChain101 is not liable for any damages or losses due to investing in or using tokens or platforms discussed within the site.