Hubble’s Law helps people understand that most objects in space are moving away from us, and that their distance from us is proportionate to the speed in which they are moving. This involves the concept that all things originated from a single point, and have been expanding out and away from each other at a somewhat constant speed ever since. For Vechain, this singular point may be hard to pin down, but for the purposes of what we are discussing, let’s go back to September 6th, 2016, when BitSE (Vechain’s previous parent company) announced their partnership with Kuehne & Nagel. This set things in motion, and one of the world’s first supply chain-based blockchain-as-a-service (BaaS) companies was thrust into the limelight.

From there, things soon began to evolve. Fashion designers Babyghost were added to the mix, and Liaoning Academy of Agricultural Sciences began toying with the idea of using IoT devices and the blockchain to regulate soil and climate conditions around crops. For a long time, CEO Sunny Lu and his team were able to keep everything under the Vechain umbrella, and eager investors salivated over every rumor and press release that detailed just how far this universe could expand. Rumor after rumor formed in this linear fashion, and the price continued to surge. This culminated with the rebranding event on February 26th, 2018, where Vechain went on to announce further partnerships including VeResearch, dApps, ICO’s, and a Carbon Bank initiative with DNV GL.

For many, this was too good to be true. How could one company plan to do so much? As the bear market began to take its grip, people’s doubts became fears, and as summer rolled around, manifested into a -90% price nightmare. Many wrote off Vechain as a scam, a hustle, created in China to extract money from gullible westerners. Many thought back to February 26th, with the gaudy ornamental hammer that CEO Sunny Lu, DNV GL’s Luca Crisciotti, and PwC China’s Elton Huang had slammed on the podium, and wondered how they could have been duped by such an obvious scam.

But this wasn’t a scam, as nearly 10 months on, we’ve seen steady progress with flurries of new developments mixed in. That hammer in Singapore was the point where things split. The singularity, where Vechain’s ecosystem began to aggressively move apart.

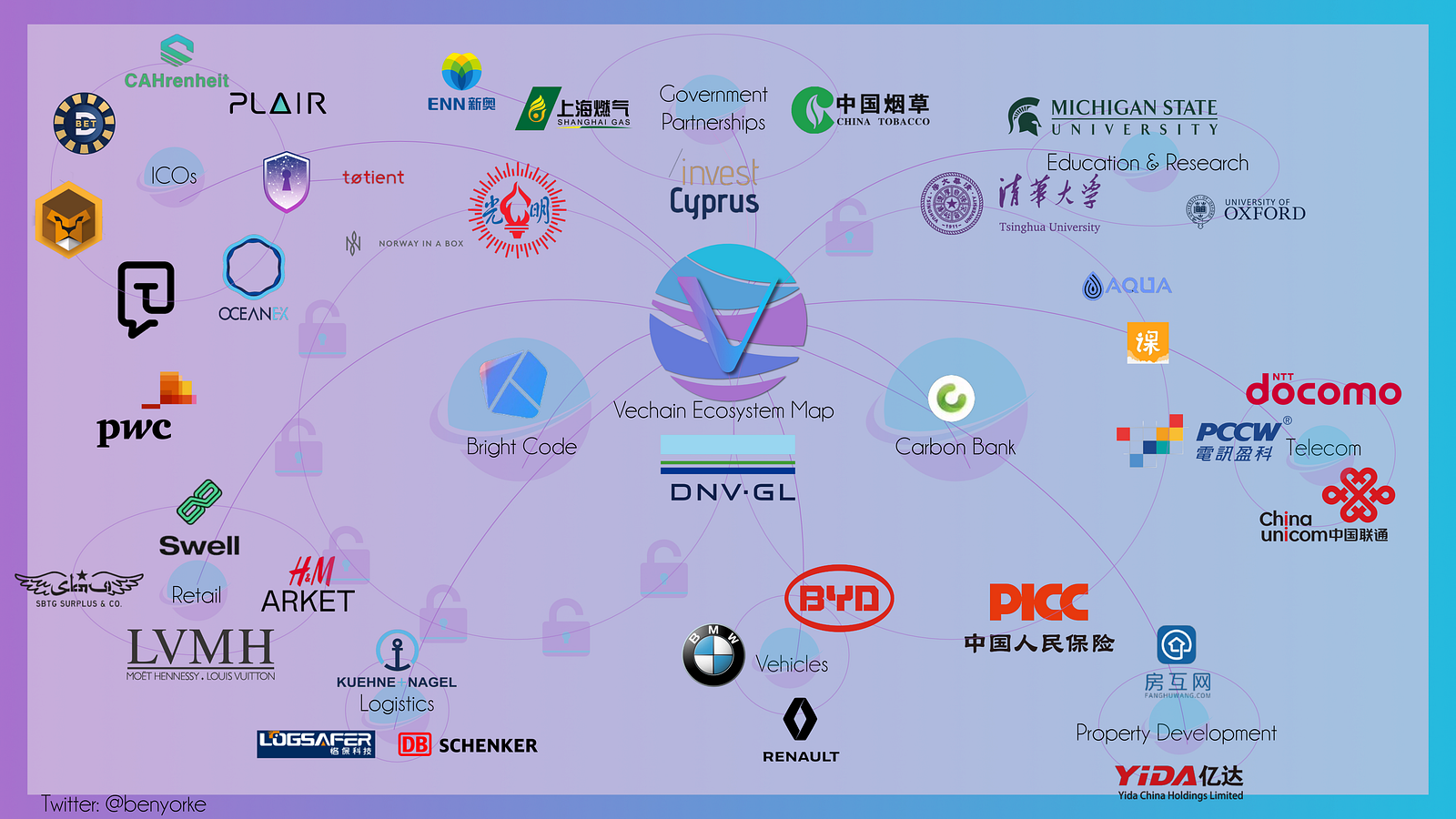

And now, with 2018 coming to a close, we struggle to grasp the total scope of the ecosystem. DNV GL has grasped the food safety initiative by the horns with their Bright Code platform, created in conjunction with the second-largest food manufacturer in China, Bright Foods. Secondly, the Carbon Bank initiative has joined forces with the world’s largest electric car producer, BYD, and one of China’s largest state-owned insurance providers, PICC. Tsinghua University, Michigan State, and Oxford University continue the research initiatives set out by Vechain. A handful of ICO’s cover everything from protecting animal rights (Cecil Alliance), gaming (Plair), casino gaming and betting on sports (Decent.Bet), as well as token management (Safe Haven). Newly launched exchange OceanEx creates a platform where digital assets can be exchanged. Shanghai Gas and ENN holdings are creating a liquid natural gas solution to manage the production and storage of LNG products. The recent announcement of Swell has created a project dedicated to verifying the authenticity of shoes and fashion products. Aqua and Taotaoke are busy creating solutions for protecting and monetizing digital media. With each of these individual projects having a high chance of succeeding, the Vechain universe is well and truly split.

Fragmentation as a Business Model

When I first began explaining Vechain to friends, I mistakenly told them that in a few years we’d be using Vechain chips to verify a number of products we use in our daily lives. This appeared to be the plan, and something Vechain’s various Proof-of-concepts demonstrated was possible. Bottled wine, tea, beanies, and shoes all showcased this potential. But it leaves Vechain with a difficult task in a highly-competitive blockchain space: running around trying to convince other industries to adopt and continue using the Vechain’s technology.

Instead, we’ve seen the fragmentation resulting from Vechain encouraging industry leaders to develop their own solutions on Vechain’s core blockchain technology. By developing their own apps and solutions, industries maintain control over their users, data, and branding. To think that we’d be browsing a grocery store and see people pulling out smartphones to scan a bottle of milk with their Vechain apps was silly. What’s far more likely is that business will embed the decentralized blockchain into their own apps, and customers will unwittingly be accessing the Vechain blockchain through each product they verify.

Why is this strategy far more beneficial?

- Industries will have specialized solutions, with specialized branding that appeal to their customers and needs.

- Enterprises will be able retain control of their customer relationship management (CRM) and information systems.

- Fragmentation will result in resources being utilized more efficiently and cost-effectively.

- More effective than a one-blockchain-fits-all approach, that would alienate certain user groups and industries.

Many long-term investors of Vechain will be looking at some of the recent developments and be wondering how exactly we got to where we are today. But the fact is simple, specialized use-cases need specialized solutions, especially when professional industries are involved. In my opinion, if Vechain truly succeeds, it will do so as a backbone of BaaS solutions, much like Oracle or Cisco power many of our business solutions without the general public ever realizing it. Memories of the hammer may fade away, and exist as an inside joke among early investors.

But like Hubble’s Law states, the further apart something appears, the faster the velocity with which it has been traveling.

As Vechain’s universe continues to spread apart, these projects created along the way add incredible value to the platform. Bright Foods can connect to Chinese consumers in ways Vechain never could. PICC can connect with more account holders, BYD can connect with more drivers, Shanghai Gas can connect with more refineries, all without Vechain breaking a sweat. The open nature of these platforms will require digital data management solutions that will be the core of Vechain’s services, and create a multitude of opportunities for third parties to participate and extract value. The amount of data that the hundreds of millions of customers that PwC, DNG GL, BYD, Shanghai Gas, Bright Foods, and PICC will bring to this blockchain should be staggering, and enough to placate even the most-anxious of investors.

Most importantly, this should alleviate a consistent fear critics have of the two-token system: Does a company need to hold the token to use the platform? The short answer is no, but with the sheer volume of data, VTHO consumption will surely reach a point where it exceeds daily production, and began rising in value. While it’s highly unlikely that happens anytime in the next few weeks or even months, I believe token price appreciation should increase based upon:

- Massive exposure from industries and enterprises indirectly promoting their own projects.

- Third party dApps seeking to take advantage of a high volume data marketplace.

- Acceptance and positive regulation by the governments who see value in sustainable projects set forth by DNV GL.

- Companies seeking the convenience of producing their own VTHO versus buying on the market.

I attempted to make this map to visualize where it all ends up. I gave up, after I realized the links were too far apart, and spreading further with each passing day. Whatever the result is, it’s almost impossible to identify the limits of what Blockchain technology might be. Many companies are flirting with the known boundaries, but for me Vechain crashes through, bringing potential solutions that not only generate value but also increase safety and sustainability on a global spectrum. For me, I’ve stopped questioning whether or not Vechain can leave an impact on China and the global marketplace. It won’t be Vechain alone. It will be hundreds of companies, individuals, and government leaders who do all the heavy lifting. Vechain just needs to make it all link together.